Get the free cityinthe cloud registry domain id

Show details

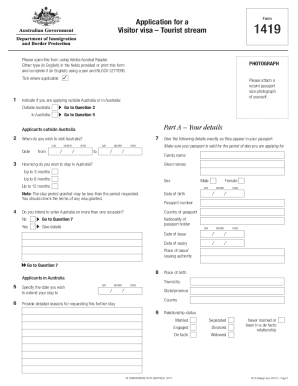

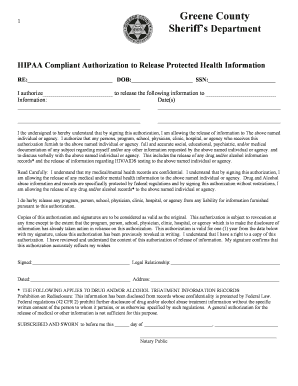

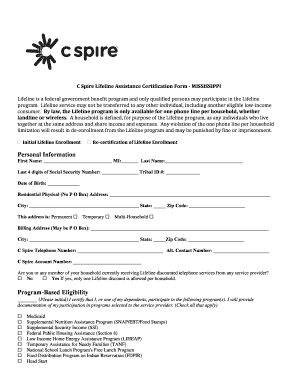

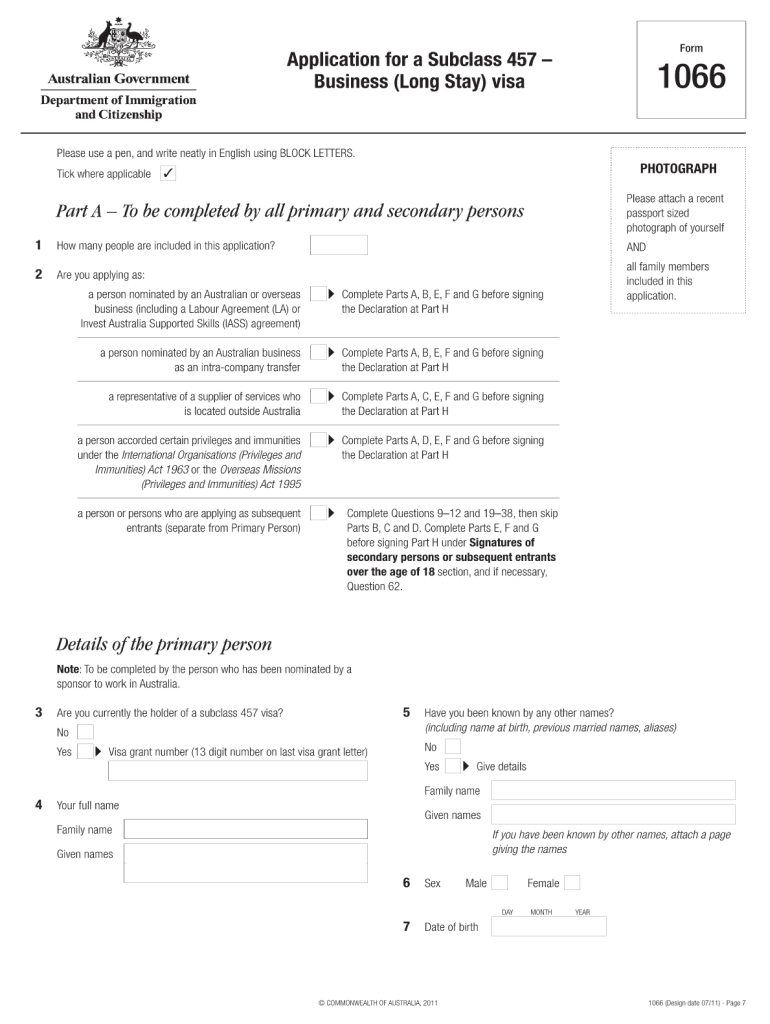

Application for a Subclass 457 Business Long Stay visa Form Current subclass 457 visa holders Who should use this form If you currently hold a subclass 457 visa you may not need to apply for a new visa if you are changing employers or if your occupation changes. To make a valid application for a subclass 457 visa with an approved standard business sponsor you must not lodge your visa application before your employer has lodged an application to become a standard business sponsor. 34 Are you...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1066 form

Edit your form 1066 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cityinthe cloud form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cityinthe cloud domain online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cityinthe cloud domain registrar form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cityinthe cloud domain registry domain id form

How to fill out 1066 form:

01

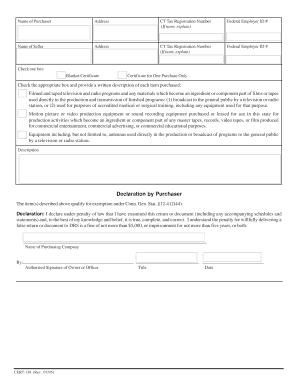

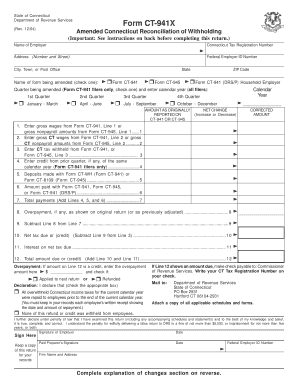

Gather all necessary information and documentation required for the form, such as personal details, financial information, and supporting documents.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Start by entering your personal information accurately, including your full name, address, and social security number.

04

Proceed to complete the sections related to your income, deductions, and credits. Provide accurate and detailed information to support your tax filing.

05

Double-check all the entered information to ensure accuracy and make any necessary corrections.

06

Sign and date the form as required and attach any additional schedules or forms that are applicable.

07

Make a copy of the completed 1066 form and all supporting documents for your records.

08

Submit the form to the appropriate tax authority by the deadline.

Who needs 1066 form:

01

Individuals who have received taxable income from certain sources, such as partnerships, trust funds, estates, or real estate mortgage investment conduits (REMICs), may need to fill out 1066 form.

02

Taxpayers who have been allocated income, deductions, or credits from any of the mentioned sources should also complete this form.

03

It is important to consult the IRS guidelines or a tax professional to determine if you need to file the 1066 form based on your specific circumstances.

Fill

registry domain id cityinthe cloud

: Try Risk Free

People Also Ask about form 186

What is a 1065 tax form?

Schedule D (Form 1065), Capital Gains and Losses Use this schedule to report: The overall capital gains and losses from transactions reported on Form 8949, Sales and Other Dispositions of Capital Assets. Certain transactions the partnership doesn't have to report on Form 8949.

What is the 1066 schedule?

español. Assembly Bill 1066 (2016) created a timetable for agricultural workers to receive overtime pay so that they will gradually receive overtime pay on the same basis as workers in most other industries. *Double the regular rate of pay required after 12 hours in a workday.

What is a form 1065?

Partnerships use Schedule B-1 (Form 1065) to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

What's the 1099 tax form?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

What is a 1066 tax form?

Purpose of Form File Form 1066 to report the income, deductions, and gains and losses from the operation of a REMIC. In addition, the form is filed by the REMIC to report and pay the taxes on net income from prohibited transactions, net income from foreclosure property, and contributions after the startup day.

What is a 1099 tax form?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdf download to be eSigned by others?

When your fill online cityinform cloud is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find fill online cityinform cloud?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific fill online cityinform cloud and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the fill online cityinform cloud in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your fill online cityinform cloud right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is 1066 visa?

The 1066 visa refers to a specific type of visa used in certain countries, primarily in the context of immigration and travel. It may have specific eligibility criteria and purposes depending on the issuing government's regulations.

Who is required to file 1066 visa?

Individuals seeking to enter or reside in the country under the provisions of the 1066 visa must file it. The specific requirements may vary based on the individual's nationality, purpose of travel, and other factors as outlined by the issuing authority.

How to fill out 1066 visa?

To fill out the 1066 visa, applicants should obtain the official form from the relevant immigration authority, provide accurate personal and travel information, and submit any required supporting documents. It is crucial to follow the instructions provided and ensure all information is correctly entered.

What is the purpose of 1066 visa?

The purpose of the 1066 visa typically revolves around allowing individuals to travel, reside, or engage in specific activities in the host country, as defined by the visa's guidelines and the issuing country's immigration laws.

What information must be reported on 1066 visa?

The 1066 visa application generally requires applicants to report personal information, including their full name, date of birth, nationality, travel details, purpose of visit, and possibly financial and health-related information, depending on the requirements of the issuing authority.

Fill out your fill online cityinform cloud online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fill Online Cityinform Cloud is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.