Get the free cityinthe cloud registry domain id

Fill out, sign, and share forms from a single PDF platform

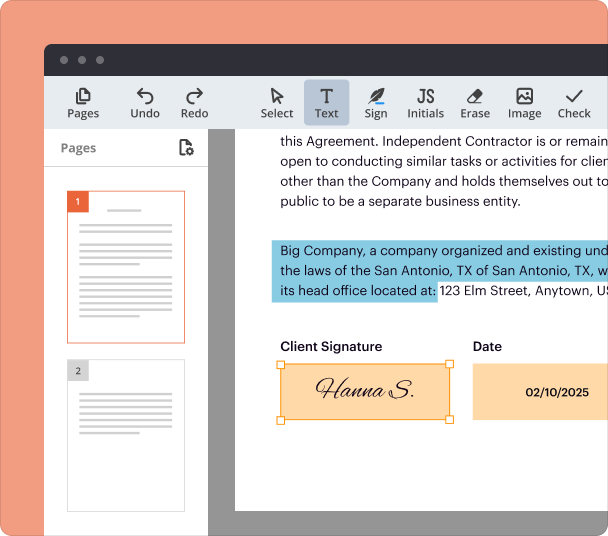

Edit and sign in one place

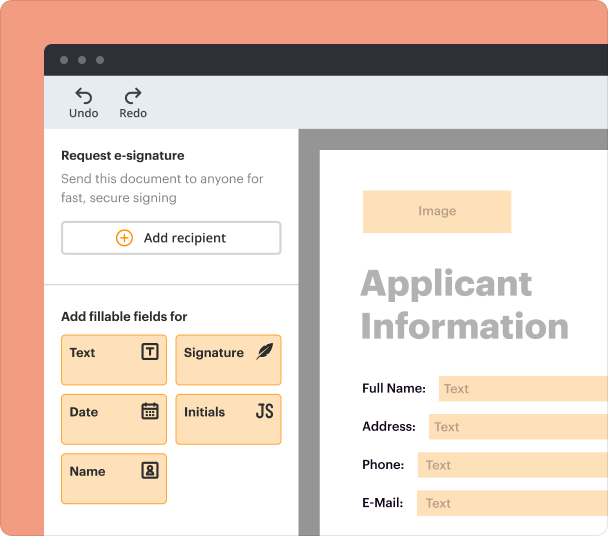

Create professional forms

Simplify data collection

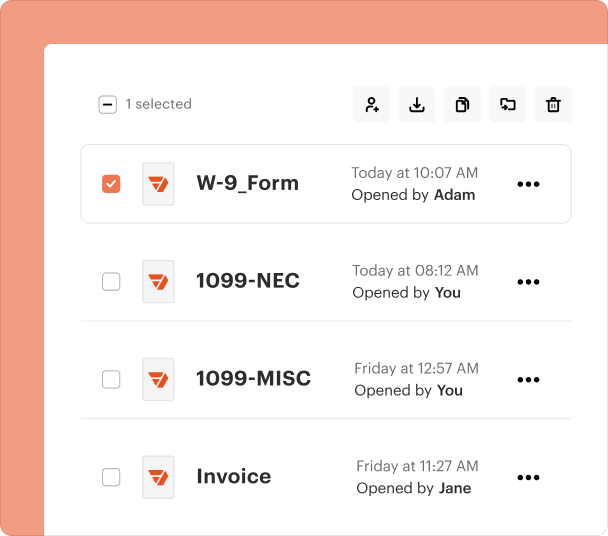

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to the 1066 Form

Understanding the 1066 Form

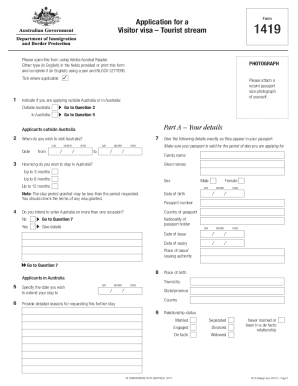

The 1066 form is a crucial document used in U.S. immigration procedures, typically associated with applications for certain visa types. This form, often referred to as the 1066 visa form, is essential for individuals seeking to obtain or change a visa status within the United States. Understanding the specific use and requirements of this form is vital for applicants aiming to navigate the immigration process successfully.

When to Use the 1066 Form

The 1066 form should be utilized when an applicant aims to apply for a visa under specific categories that require formal application processes. It is particularly relevant for individuals who are changing their immigration status or are applying for a new visa type. Additionally, it may be required when an applicant's current visa is expiring, and they need to submit a new application to remain in the U.S. legally.

Eligibility Criteria for the 1066 Form

To qualify for the 1066 form, applicants must meet specific eligibility criteria outlined by U.S. immigration authorities. This includes having a legitimate reason for applying and ensuring compliance with any previous visa conditions. Generally, individuals must show proof of financial stability and intent to comply with U.S. laws during their stay. It's important to review the criteria thoroughly to ascertain eligibility prior to submission.

Required Documents and Information

Filling out the 1066 form requires various documents and information. Applicants will typically need to provide personal identification, such as a passport, along with information regarding their current visa status and any supporting documentation that validates their application, like employment letters or financial statements. Gathering all necessary documents in advance can streamline the completion process.

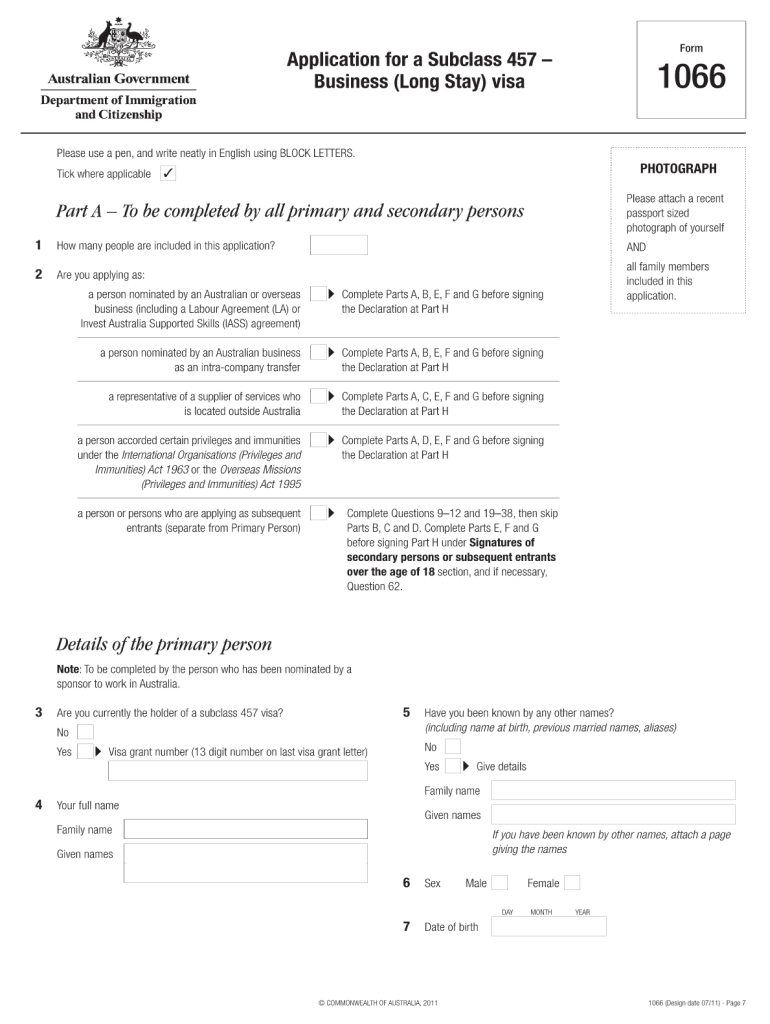

How to Fill Out the 1066 Form

Properly completing the 1066 form involves careful attention to detail. Applicants should start by reading the instructions thoroughly. Each section of the form must be filled accurately, using clear and concise language. It's advisable to double-check for any inconsistencies or potential errors before finalizing the form to ensure all information matches supporting documentation.

Common Errors and Troubleshooting

Common errors while completing the 1066 form can include incorrect personal information, missing signatures, or incomplete sections. Such mistakes can lead to delays in processing or potential rejections. Readers should be aware of these common pitfalls and take proactive measures to review their forms carefully, possibly seeking assistance if needed to ensure all information is accurate and complete.

Frequently Asked Questions about 1066 form

What is the 1066 form used for?

The 1066 form is used for applying or changing visa statuses within the U.S. and is essential for certain visa applications.

Who needs to fill out the 1066 form?

Individuals changing their visa status or applying for new visas under specific categories must fill out the 1066 form.

What documents are required with the 1066 form?

Applicants typically need to provide identification like a passport, current visa details, and supporting documents like financial statements.

What are common mistakes to avoid when filling out the 1066 form?

Common mistakes include providing incorrect information, missing signatures, and leaving sections incomplete.

pdfFiller scores top ratings on review platforms