Fill Online 1066 visa form

Show details

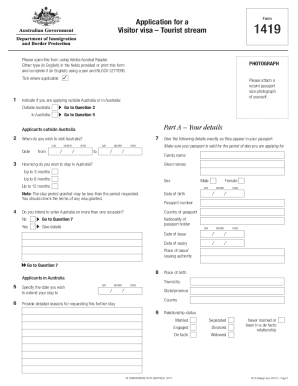

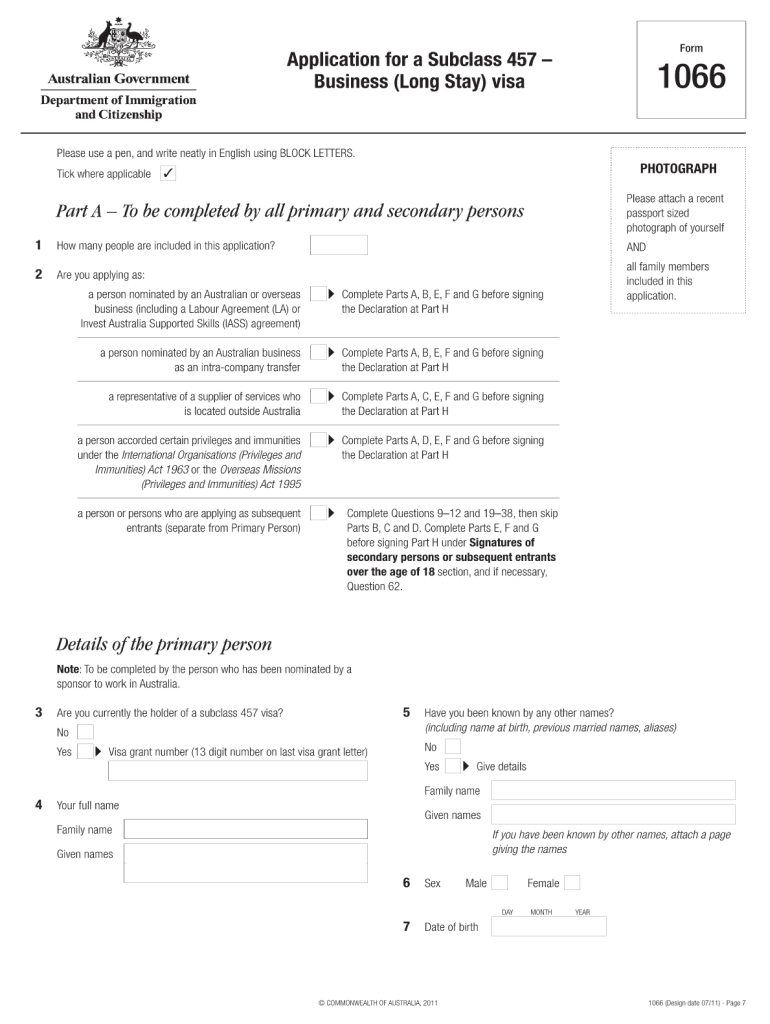

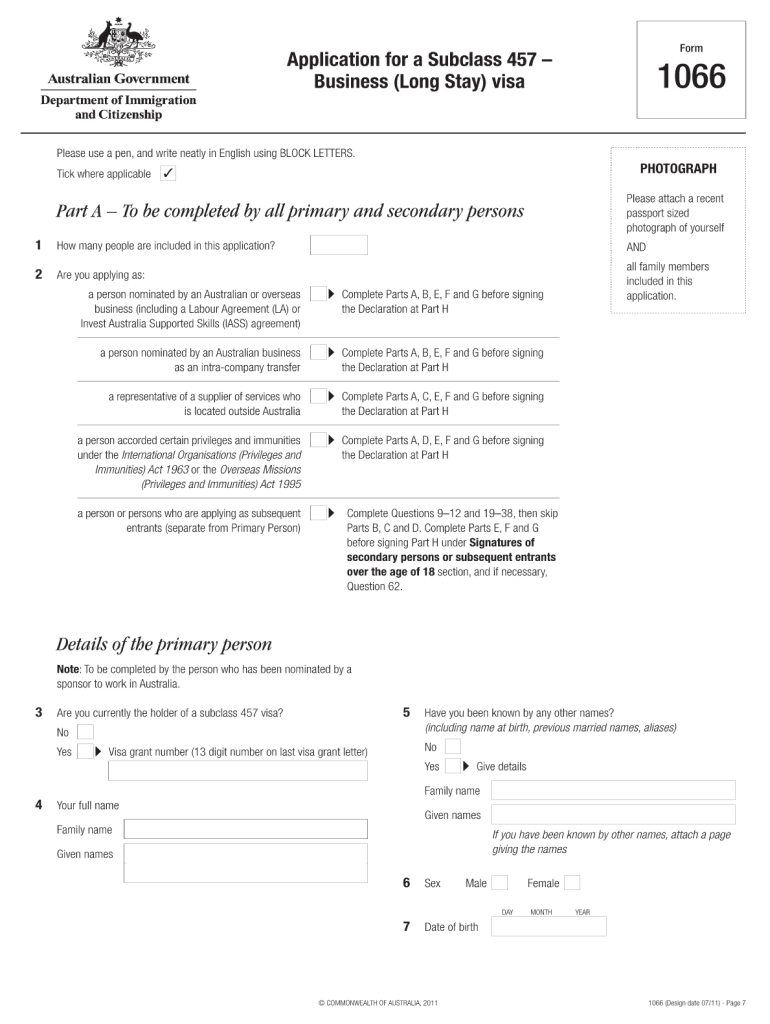

Application for a Subclass 457 Business Long Stay visa Form Current subclass 457 visa holders Who should use this form If you currently hold a subclass 457 visa you may not need to apply for a new visa if you are changing employers or if your occupation changes. To make a valid application for a subclass 457 visa with an approved standard business sponsor you must not lodge your visa application before your employer has lodged an application to become a standard business sponsor. 34 Are you...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your fill online 1066 visa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fill online 1066 visa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1066 visa online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 457. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out fill online 1066 visa

How to fill out 1066 form:

01

Gather all necessary information and documentation required for the form, such as personal details, financial information, and supporting documents.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Start by entering your personal information accurately, including your full name, address, and social security number.

04

Proceed to complete the sections related to your income, deductions, and credits. Provide accurate and detailed information to support your tax filing.

05

Double-check all the entered information to ensure accuracy and make any necessary corrections.

06

Sign and date the form as required and attach any additional schedules or forms that are applicable.

07

Make a copy of the completed 1066 form and all supporting documents for your records.

08

Submit the form to the appropriate tax authority by the deadline.

Who needs 1066 form:

01

Individuals who have received taxable income from certain sources, such as partnerships, trust funds, estates, or real estate mortgage investment conduits (REMICs), may need to fill out 1066 form.

02

Taxpayers who have been allocated income, deductions, or credits from any of the mentioned sources should also complete this form.

03

It is important to consult the IRS guidelines or a tax professional to determine if you need to file the 1066 form based on your specific circumstances.

Video instructions and help with filling out and completing 1066 visa

Instructions and Help about app 457 form

Fill 457 visa application form : Try Risk Free

People Also Ask about 1066 visa

What is a 1065 tax form?

What is the 1066 schedule?

What is a form 1065?

What's the 1099 tax form?

What is a 1066 tax form?

What is a 1099 tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1066 form?

The 1066 form is a tax form used by partnership businesses to report income and losses for the tax year. It must be submitted to the Internal Revenue Service (IRS) by the 15th day of the third month following the end of the tax year. This form is used instead of the 1065 form which is used for corporations.

How to fill out 1066 form?

1. Enter your business name, address, and EIN in the "Name/Address/EIN" section.

2. Enter the name of the partnership or S corporation in the "Name/Address/EIN" section.

3. Enter the total amount of the partnership or S corporation's income, deductions, and credits in the "Total Income" section.

4. Enter the total amount of the partnership or S corporation's distributions in the "Distributions" section.

5. Enter the total amount of the partnership or S corporation's deductions from the distributive shares in the "Deductions from Distributive Shares" section.

6. Enter the total amount of the partnership or S corporation's taxes in the "Taxes" section.

7. Enter the total amount of the partnership or S corporation's credits in the "Credits" section.

8. Enter the total amount of the partnership or S corporation's net income in the "Net Income" section.

9. Enter the total amount of the partnership or S corporation's adjustments to net income in the "Adjustments to Net Income" section.

10. Enter the total amount of the partnership or S corporation's balance due or overpayment in the "Balance Due or Overpayment" section.

What is the purpose of 1066 form?

The 1066 form is used by individuals who are filing federal taxes as a real estate investment trust (REIT). It is used to report the income, deductions, gains, losses, credits, and other information related to the taxation of REITs.

What information must be reported on 1066 form?

The 1066 form, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, requires information about the REMIC's business activity, including the number of mortgages held, gains and losses from dispositions, distributions to investors, gross income, and deductions. Additionally, the form requires information about the REMIC's election to be classified as a corporation or a trust, any tax-exempt bonds held, and any foreign financial accounts held.

What is the penalty for the late filing of 1066 form?

The penalty for the late filing of a 1066 form is $195 per partner, per month, up to a maximum of 12 months.

Who is required to file 1066 form?

The 1066 form is used to report the final year-end information for a real estate mortgage investment conduit (REMIC). The REMIC is generally required to file Form 1066 if it has reportable income, sections 860E through 860G require certain information to be reported to the IRS and the beneficial owners of the REMIC as of the close of the calendar year.

How can I send 1066 visa to be eSigned by others?

When your form 457 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find form 1436?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific form 1066 visa and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the form 1066 immigration in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your form 1066 australian immigration right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your fill online 1066 visa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1436 is not the form you're looking for?Search for another form here.

Keywords relevant to form 1066

Related to australian visa form 1066

If you believe that this page should be taken down, please follow our DMCA take down process

here

.